Get on the path to results today.

Get on the path to results today.

Tax Assistance Services Please ☎️ 678-907-4195

Preparation and filing of tax returns

Identifying deductions and credits call ☎️ 678-907-4195

Tax planning Please call ☎️ 678-907-4195

A tax preparer's core service is to complete and file federal and state tax returns for clients. This involves gathering and organizing financial documents like W-2s, 1099s, and expense receipts.

Tax planning Please call ☎️ 678-907-4195

Identifying deductions and credits call ☎️ 678-907-4195

Tax planning Please call ☎️ 678-907-4195

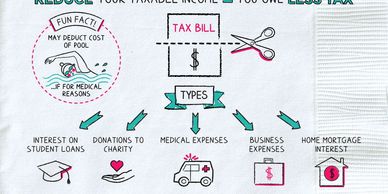

Beyond just filing, a tax professional helps clients develop long-term strategies to minimize their tax burden. This can involve advising on financial decisions related to retirement planning, charitable contributions, and business expenses.

Identifying deductions and credits call ☎️ 678-907-4195

Identifying deductions and credits call ☎️ 678-907-4195

Assistance with audits and IRS representation Call ☎️ 678-907-4195

Tax preparers analyze a client's financial situation to find all eligible tax deductions and credits. This ensures the client pays the minimum legal tax liability and gets the maximum possible refund.

Assistance with audits and IRS representation Call ☎️ 678-907-4195

Assistance with audits and IRS representation Call ☎️ 678-907-4195

Assistance with audits and IRS representation Call ☎️ 678-907-4195

If a client receives an audit notice from the IRS or a state tax agency, a tax preparer can act as a representative and communicate with the tax authorities on the client's behalf.

Bookkeeping and payroll services ☎️ 678-907-4195

Assistance with audits and IRS representation Call ☎️ 678-907-4195

Bookkeeping and payroll services ☎️ 678-907-4195

Many tax preparers, especially those who specialize in small businesses, also provide related services like bookkeeping and payroll management. This helps ensure financial records are accurate and organized throughout the year.

Amending prior-year returns call ☎️ 678-907-4195

Assistance with audits and IRS representation Call ☎️ 678-907-4195

Bookkeeping and payroll services ☎️ 678-907-4195

Tax preparers can review a client's past tax returns to identify and correct any errors or missed deductions. This can lead to a client receiving a larger refund

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.